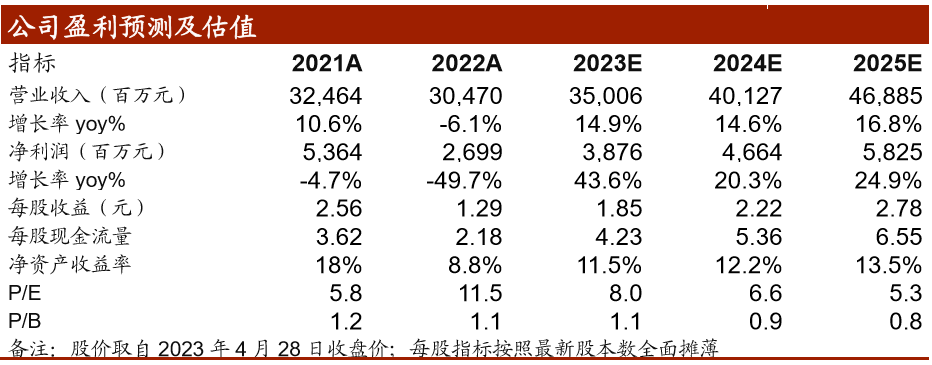

Comments on the 2023 First Quarter Report of Huaxin Cement: Demand remains weak in the short term, and the proportion of non cement

The proportion of gross profit in non cement business has further increased, and the profit per ton is expected to bottom out and repair.

Under the influence of the high base price in Q1 2022, the price of tons in Q1 2023 is expected to significantly decrease year-on-year.

However, we expect the non cement business to continue to be the core factor driving revenue growth.

We expect that the aggregate and concrete businesses will be affected by the decrease in prices, and the unit gross profit will decrease.

However, considering that Q1 is usually the high point of the company’s ton cost, and with the subsequent weak recovery of demand and Q2 staggered peak support, prices tend to stabilize, coupled with stable coal prices, we expect that the company’s single ton profit is expected to gradually recover, and non cement businesses also provide strong profitability resilience

.

From a cost perspective, the ton cost of 23Q1 company is 76.5 yuan/ton, a year-on-year increase of 11.5 yuan, which may be related to the increase in cost sharing caused by volume reduction.

The comprehensive gross profit margin of the 23Q1 company is 20.2%, with a year-on-year increase of -6.1 pct.

In summary, it is expected that the net profit attributable to the parent company of 23Q1 tons will still be in the bottom range.

From a cost perspective, although the decline in sales has had an impact on cost sharing, the company’s ton cost may have slightly decreased due to the stable and declining coal prices (23Q1 coal industry prices -3.7% year-on-year); The gross profit per ton is expected to significantly decrease year-on-year, mainly affected by the price decline.

Market demand remains weak, and non cement businesses continue to increase in volume to support a slight increase in revenue.

Although the demand for key engineering projects remains good, the poor real estate situation and shortage of funds will still have a significant impact on cement demand, and the company’s sales may slightly decrease in the same quarter.

However, driven by the increase in their own volume and the decrease in the gross profit of the cement main business, the overall proportion of non cement business gross profit will significantly increase.

With the support of production capacity investment in 2022, we expect the aggregate and concrete businesses to continue to expand, driving the non cement business to maintain rapid growth, and integrated development to contribute to growth momentum.

In Q1 2023, the company achieved a revenue of 6.63 billion yuan,+1.49% year-on-year; Realized a net profit attributable to the parent company of 250 million yuan, a year-on-year increase of -63.1%; Deduction of non attributable net profit of 230 million yuan, a year-on-year increase of -64.0%; The net cash flow from operating activities was 330 million yuan,+203.9% year-on-year.

Key investment points: Event: The company released its first quarter report for 2023.

In terms of cement main business, we expect that the overall market area where the company is located in Q1 2023 will still be weak, especially due to multiple factors such as the Spring Festival from January to February.