Conch Cement | 2023 First Quarter Report Review: Profits Reached Bottom, Waiting for Industry Supply and Demand to Repair

But looking forward to the whole year, demand side infrastructure investment is expected to support the marginal repair of cement demand.

The new construction of 23Q1 real estate is still weak, and the cost remains high.

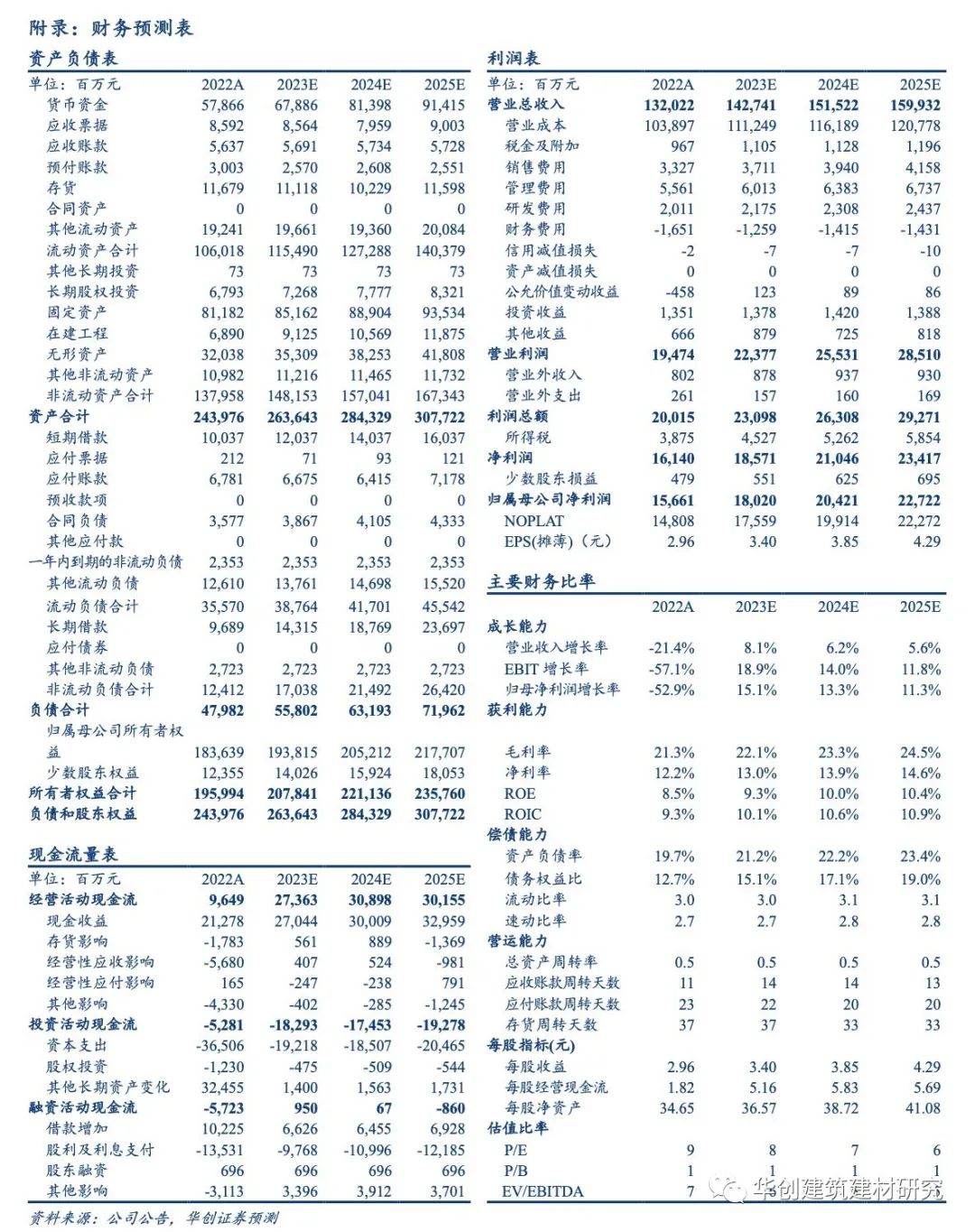

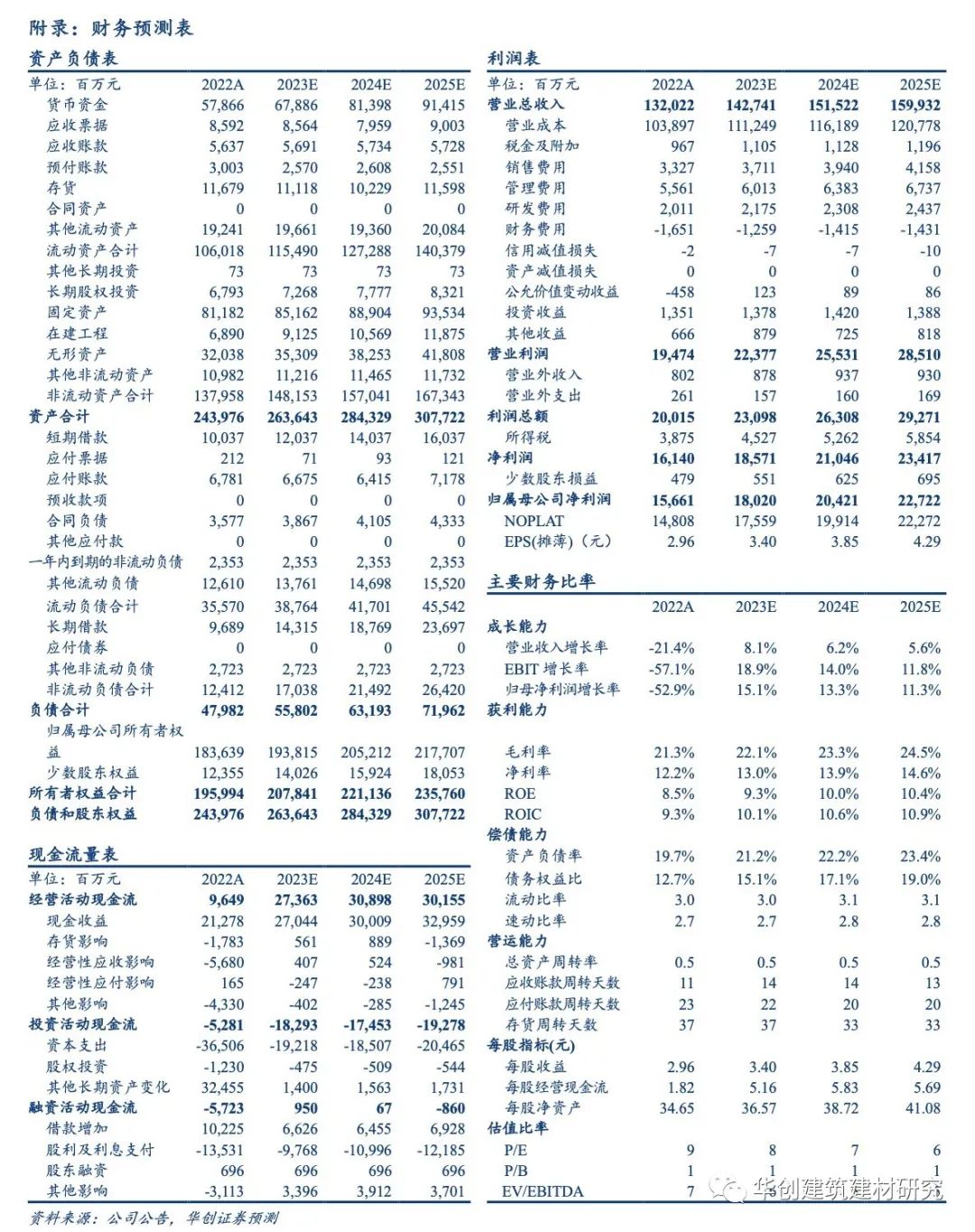

The company achieved a revenue of 31.37 billion yuan in the first quarter of 2023, a year-on-year increase of 23.18%, and a net profit attributable to the parent company of 2.55 billion yuan, a year-on-year decrease of 48.20%.

Profit bottoms out, waiting for industry supply and demand to repair.

The company released its first quarter 2023 report: the company achieved a revenue of 31.37 billion yuan in the first quarter of 2023, a year-on-year increase of 23.18%; The net profit attributable to the parent company was 2.55 billion yuan, a year-on-year decrease of 48.20%; The net profit attributable to non parent companies was 2.16 billion yuan, a year-on-year decrease of 52.87%.

In terms of price, according to Digital Cement Network, the cement price for 23Q1 in the East China region decreased by 16% year-on-year and slightly decreased by 4% month on month.

Commenting on industry-leading revenue growth, gross profit margin rebounded month on month.

The “Management Measures for the Appropriateness of Securities and Futures Investors” and supporting guidelines are only intended for professional investors in financial institutions among Huachuang Securities clients.

It is difficult to set access permissions for this information.

Most enterprises in the industry have suffered losses.

With the trend of rebound in real estate demand, new construction projects in real estate are also expected to gradually narrow the decline; The supply side industry has formed a pessimistic consensus expectation, and constraint mechanisms such as staggered production are expected to be further strengthened.

1) Production capacity and capital expenditure: In 2022, the company’s capital expenditure was 23.9 billion yuan, mainly used for mining rights acquisition, project construction investment, and mergers and acquisitions

.

The repair of supply and demand is expected to drive an improvement in the company’s profitability level.

The company’s gross profit margin was 16.5%, with a slight increase of 2.6 pct month on month.

Thank you for your understanding and cooperation.

However, the company’s revenue growth rate was relatively fast, which we believe is mainly due to the significant year-on-year growth in trade business revenue; In addition, it is expected that the company’s cement sales growth rate will be slightly higher than the industry average, and the market share will further increase.

Please do not forward this information in any form.

We estimate that this is mainly due to a slight decrease in cost side coal prices.

The main advantages continue to be consolidated, and business diversification develops.

According to the National Bureau of Statistics, the national cement production in the first quarter was 402 million tons, a year-on-year increase of+4.10%.

Since April, due to the disturbance of rainy weather and the end of the first round of staggered production in the industry, cement prices are still under pressure.

If you are not a financial institution professional investor among Huachuang Securities clients, please do not subscribe, receive or use the information in this material.

In terms of cash flow, the company’s net operating cash flow increased from+220 million to 3.094 billion year-on-year, achieving a positive year-on-year increase despite a significant decline in net profit.

We apologize for any inconvenience caused.