The cement price rose for the first time this year, and the plate index rose sharply! The institutions are optimistic about the medium and

The price increase is mainly concentrated in East China and South China, with a range of 10-30 yuan/ton.

Cement is expected to be included in the carbon trade in the future.

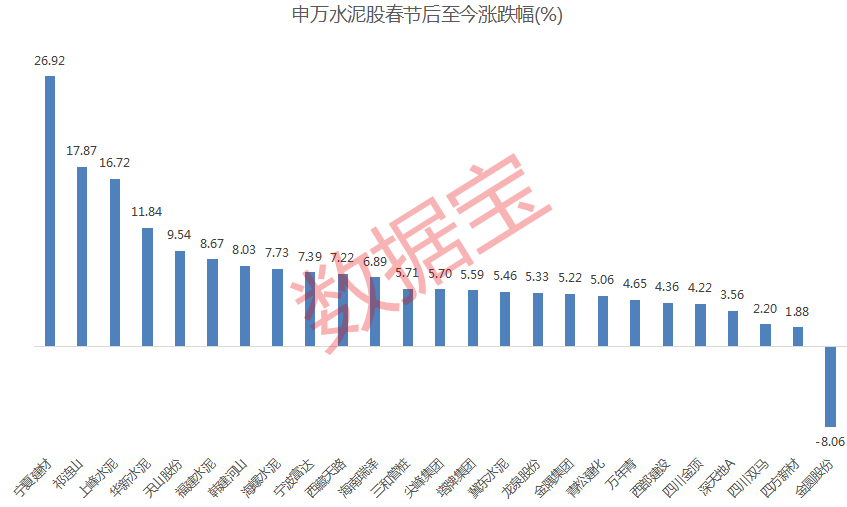

Ningxia building materials rose the first, 26.92%; Qilian Mountain, Shangfeng Cement, Huaxin Cement and other three stocks rose more than 10%.

Extending the time line, the cement index has risen steadily since the Spring Festival, but the overall increase is small, at 7.52%.

The price center is expected to gradually rise, and the second growth pole will be created through aggregate and other businesses.

The net inflow of conch cement was the first, with 144 million yuan; The net inflow of Huaxin Cement and Tianshan Shares exceeded 60 million yuan; The net inflow of Shangfeng Cement and Jinyu Group is about 20 million yuan.

Today, 8 cement stocks received more than 10 million yuan of main capital injection.

The sales revenue of the chemical sector of the company increased by 67% compared with 2021, the sales profit increased by 81 million yuan compared with 2021, and the non-recurring profit and loss increased by 131 million yuan year-on-year.

On the one hand, the cement price has fallen to the bottom before, and the enterprises are willing to raise the price; On the other hand, it also benefited from the significant increase in peak shifting production in 2023, and the decline in weekly inventory, which led to the rise in prices.

In 2022, the performance of cement shares was generally poor.

Focus on tracking the relevant indicators of cement demand, especially the physical workload of infrastructure construction.

On February 20, Shenwan Cement Index rose 3.95%.

From the perspective of dividend yield and valuation, cement shares still have a certain investment value ratio.

According to the news, in the middle of February, the domestic cement market demand continued to recover slowly, and the shipments of enterprises in East China, Central China and South China generally recovered to 4-5%; The southwest Sichuan and Chongqing area can reach 4-6%, Yunnan-Guizhou 2-4%, and Beijing-Tianjin-Hebei 2-3%.

In terms of agency attention, Conch Cement, Huaxin Cement and Shangfeng Cement ranked first, with 27, 21 and 12 rating agencies in turn; Tianshan Shares, Sichuan Shuangma, Jidong Cement, and Tabai Group have also been rated by more than five institutions recently.

Affected by factors such as the decline of the real estate market and the repeated epidemic situation, the market demand for cement has declined, and the sales price and sales volume of the company’s cement products have declined year on year; At the same time, affected by the rise in coal prices and electricity prices, the company’s product costs rose year-on-year.

At present, cement fundamentals and valuation may be at the bottom of history.

Benefiting from the good performance of the staggered peak production of enterprises, after the weather improved, with the slow recovery of downstream demand and the decline of inventory, enterprises around the country actively promoted the price recovery increase in order to improve the profitability.

It is estimated that the net profit in 2022 will be 13.973 billion yuan to 16.633 billion yuan, a year-on-year decrease of 50% to 58%.

Jinyuan shares alone fell by 8.06%.

Driven by the guaranteed delivery of real estate and the resumption of construction of multiple projects to drive the demand for cement; The lag of the physical workload of infrastructure construction in 2023 is likely to be large; In addition, the current coal price has fallen to a certain extent, and the pressure on the cost side has been marginally reduced.

It is expected to further expand through mergers and acquisitions.

According to the lower limit of the forecast interval, Sanhe Pipe Pile is expected to have a net profit of 130 million yuan in 2022, with a year-on-year increase of 66.06%.

Bank of China Securities also said that the medium and long term logic of cement industry synergy has not changed, and 2023 is relatively optimistic.

According to the statistics of Securities Times and Databank, as of February 20, 21 cement listed companies in the A-share market had issued performance forecasts, and one of them had issued performance reports.

The institutions are optimistic about the future performance of the industry.

Qingsong Jianhua is expected to have a net profit of 416 million yuan in 2022, up 32% year on year; Deduct 348 million yuan of non-net profit, a year-on-year decrease of 7.8%.

The leading competitive advantage is prominent.

The current cement fundamentals and valuation are at the relative bottom of history.

Editor-in-chief: Xie Yilan Proofread: Shujubao 2015: Smart original new media of the Securities Times..

.

There are only 1 pre-increase and 1 slight increase, respectively, Sanhe Pipe Pile and Qingsong Jianhua.

Statement: All information on Databank does not constitute investment suggestions.

There are 11, 5, 2 and 1 types of advance notice, which account for more than 90% in total.

The cement fundamentals and valuation are at the bottom.

CSCI said that the cement price rose slightly last week.

Tianfeng Securities believes that in the medium and long term, the “double carbon”+”double control” policy is expected to further optimize the industry supply pattern.

In terms of price, the national cement market price last week was 430 yuan/ton, up 5.5 yuan/ton month on month.

Among the constituent stocks, Huaxin Cement rose 7.1%; Tianshan shares rose more than 6%; The leading conch cement rose 5.66%; The peak cement rose by more than 5%.

The stock market is risky and investment needs to be cautious.

The data shows that Gebao Databao has little trouble in the stock market.

The level of cement inventory continues to decline, and there is still room for the inventory to decline in the future under the conditions of the expected good delivery rate and the continuation of the staggered peak production in the north, thus laying the foundation for the traditional peak season price increase in April.

The company said that under the condition that the revenue was less than expected, the company increased the gross profit rate of products by effectively controlling the cost of raw materials; At the same time, focus on the main business, increase the sales of customized piles and more profitable products, and further improve profitability.